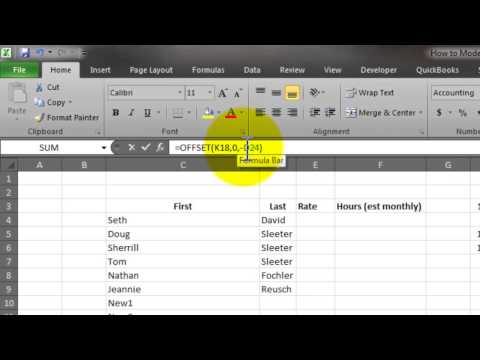

Click this screenshot above to download the

MS Excel saves the day once again as an amazing and powerful small business productivity tool. I know there are all kinds of budget apps and dashboard tools out there but when it comes down to it, none of them measure up to Excel when you really know how to play around in Excel to get the things that you need done.

With a simple layout and a couple of well written formulas you can have your financial cake and eat it too, and you don’t have to go out and buy an expensive app. You just have to have the patience (mainly with yourself) to learn something new.

- The first part is easy. Open a new Excel Workbook and get to a clean sheet.

- Then start listing your existing employees (name only). You can break it up by First and last in 2 separate columns if you like. This can be helpful later if you want to sort by Last name.

- The next part is where you want to lay out the months as a header on a line above where the first name appears. Leave a few columns in between. You’ll see why later.

- Fill in each employee’s monthly compensation. The extra columns are there in case you have hourly employees so you can calculate it based on an average (assumption) # of hours per month * their rate.

- Leave space for new employees and then set up a total line.

- Then 2 rows below the total we want to set up a line item to give us an employee count.

-

Next create a section for “Other Expenses” and set up line items for the following:

- Social Security * Medicare

- Workers Comp

- Health Insurance

- Any other expenses that are driven by payroll costs/employees.

I don’t bother with the taxes other than SS/Mcare because they are nominal (usually) in the grand scheme of things.

All of the above is pretty easy to lay out with one tricky exception. Health Insurance for 2 reasons:

- The cost is based on the # of employees

- There is usually a probationary period that has to be taken into consideration.

The video (above) will show you how to set up everything.